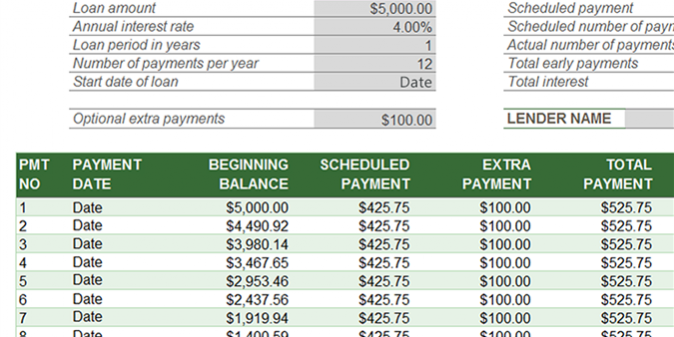

This usually implies investment in equities or similar assets which, in order to generate sufficient return, do carry a certain element of risk. If you decide against amortization, your invested capital must generate more long-term returns than the mortgage costs. What alternative form of investment will you choose for your money, and how much return will you earn on that investment?.Your mortgage interest rate: What are your interest payments, and how much of your tax savings are directly attributable to mortgage interest?.Your marginal tax rate: How much tax do you pay on additional income?.In that respect, the following three factors are of critical importance: The judgement about what level of mortgage debt could be funded primarily depends upon how the capital available for amortization is invested. Essentially, you will need to quantify the tax implications of amortization and compare this with the level of returns which might be expected if your money were invested elsewhere. Should you decide to amortize, you must also understand that the accumulated capital cannot be used for other purposes, especially after your retirement. Whether or not amortization is worthwhile is a fundamental consideration, and the decision will depend on a number of factors. The loan amortization calculator generates an amortization table that shows the principal, interest, total payment, and the remaining balance for each payment.

Our aim is to find you the best mortgage in Switzerland, help you set up a financial plan, and advise you on all mortgage issues.Įven before you arrange a personal consultation, you can use our mortgage- and affordability calculators to pre-check whether your mortgage finance request is viable. MoneyPark offers independent, in-person advice. Quickly see your monthly payment and how it is allocated between paying interest. So all mortgage holders should calculate their amortization options and seek detailed financial advice. Use this calculator to generate a mortgage amortization schedule and chart. However, even though there may be a gain from the mortgage tax savings, this is not always the case. Most mortgage holders opt to leave their mortgage outstanding so they can take advantage of the tax benefits. To do this properly, you will have to calculate the amortization and set up a precise payment schedule. Mortgage amortization: when does it pay off and which method is the best? MoneyPark mortgage adviceīenefit from independent and transparent advice in one of our branches or conveniently by phone.Īs a homeowner, you will have to decide sooner or later whether to keep your mortgage or amortize it.

0 kommentar(er)

0 kommentar(er)